what happened during 2017bthat might have cause ge to decline his net profit margin?

How The Vanderbilt Family Lost Their Entire Fortune

In the belatedly 19th century, social and technological changes allowed thousands of families to get ridiculously rich and prosper in a catamenia called the Gilded Age, as described by Fourth dimension. It was an era where flaunting your wealth publicly was all the rage, even in the face of income inequality as millions of other Americans struggled day to day. The Aureate Age was when many of the infamously wealthy families got their get-go, from the Rockefellers to the Carnegies to the Vanderbilts (via ThoughtCo). But while their legacy is still recognizable today, with their names plastered on universities and cultural landmarks, for many, their fortune has been gone for some fourth dimension now.

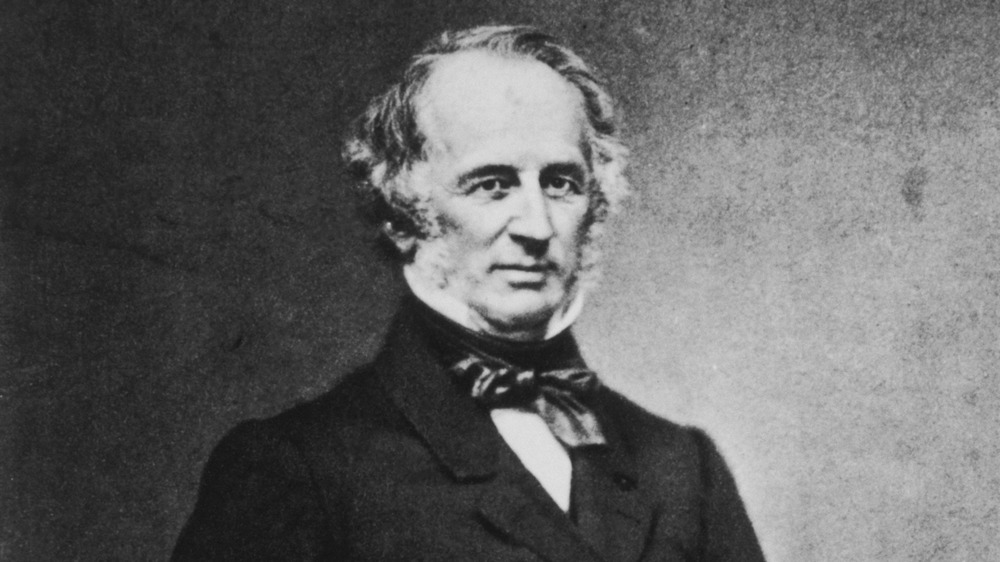

The Vanderbilts, owners of a railroad empire brought to the elevation past ruthless patriarch Cornelius "the Commodore" Vanderbilt, were in one case the richest family on the planet. As told by descendant Arthur T. Vanderbilt II in his bookFortune's Children: The Autumn of the House of Vanderbilt , not even xxx years subsequently his death in 1877, the Vanderbilt family unit had fallen off the list of the wealthiest families in the United states. Less than a century afterwards, in 1973, when 120 Vanderbilts came together for a family reunion at Vanderbilt University, there wasn't a single millionaire in attendance.

And then how does a family go from existence ane of the richest alive to having little impact in just a few generations? Here'south how the Vanderbilt family lost their entire fortune.

Information technology takes "a human of brains" to hold onto a fortune

Part of a New York farming family of pocket-size means, Cornelius "the Commodore" Vanderbilt was xvi when he borrowed $100 from his mother in exchange for plowing 8 acres of soil, according to Encyclopedia.com. The year was 1810, and the $100 (equivalent to a little over $2,100 today, per the Official Data Foundation) was spent on a boat that he used to start his own send and freight business organization.

Over time, the Commodore moved on to invest in steamships and then railroads, and before he knew information technology, he had built up the shipping and railroad empire New York Fundamental and go the richest American. At the fourth dimension of his death in 1877, his fortune was valued at $100 million (equal to nearly $2.5 billion today, via the Official Data Foundation), which was more coin than was held in the U.S. Treasury at the time, according to Forbes.

The Commodore is said to have told his oldest son, William Henry "Baton" Vanderbilt, "Any fool tin can make a fortune; it takes a homo of brains to concur onto it." Billy took the communication to center and doubled the family fortune earlier his death in 1885, just his own descendants would dwindle information technology all away in just a few decades.

The Commodore'southward passion for business didn't run in the family unit

As written by Arthur T. Vanderbilt II inFortune's Children: The Fall of the House of Vanderbilt, despite the Commodore's bang-up success as a businessman and investor, the human being was notoriously harsh and rarely trusted his family with his concern and money. His viii married daughters were ignored since they no longer bore the family unit name, but, of course, that was merely one gene that barred his daughters from taking over the business. One fourth dimension, afterwards a daughter sold her house and asked him to invest the money for her, the Commodore doubled it and so refused to return her money back. "Women are not fit to accept money anyway," he said.

By the time of his death, only two of the Commodore'south sons were alive, and only the elderberry, William "Baton" Vanderbilt, had the skills to handle the family business and fortune. The younger, Cornelius "Corneel" Vanderbilt II, was wildly irresponsible and had built up so much debt that the Commodore refused to see him fifty-fifty on his deathbed.

Rather than teaching his children his business organization skills, the Commodore ofttimes left them on their own until they could prove themselves to him. Even Billy, who concluded up existence the principal inheritor of the Vanderbilt fortune, wasn't allowed to get experience within the railroad empire until he was in his forties. Perhaps information technology'south not that surprising, then, that the futurity Vanderbilts were unprepared to handle the family fortune.

Money brought "nothing merely feet" for Baton Vanderbilt

When his begetter passed in 1877, his eldest son William "Billy" Vanderbilt inherited the bulk of his manor, including the 87-percent stake in New York Primal, co-ordinate to Forbes. While Billy was able to evidence his business organization sense to his begetter, it would be a mistake to assume that the two men had similar characters. As told by Arthur T. Vanderbilt II, the male parent and son duo couldn't accept been more different. Where the Commodore was abrasive and money-hungry, Billy was more than inclined to compromise and saw coin as a source of anxiety.

Buying of New York Key came with publicity and conflicts that Billy hated. By 1879, he was fix to sell some of his shares so that he would no longer be considered the sole owner. With the $35 one thousand thousand he made from the sale, he invested in regime bonds, a insufficiently rubber move uncharacteristic of a tycoon.

While Billy wasn't every bit ambitious as his male parent, he was obsessed with preserving his wealth and would nitpick over expenses. It is maybe with smart budgeting and a potent business acumen that Baton was able to double his inheritance to most $200 million, making him the richest homo in the world by 1883. For him, though, the money was a terrible burden. When he died in 1885, rather than entrusting the fortune to the most business-savvy descendant, he divided information technology between his ii eldest sons and so they could share the "heavy responsibility."

The "new coin" Vanderbilts bought their fashion into New York guild

Gold Historic period New York, the menses where the Vanderbilts were most prominent, was dominated by strict social hierarchy. With so many newly rich families popping up after the Ceremonious State of war and Industrial Revolution, the upper grade had to quickly take stock of who could be accepted into their elite society. According to the Museum of the Metropolis of New York, the main gatekeeper was Mrs. Caroline Schermerhorn Astor and her correct-hand human Ward McAllister. The two created the famous "List of 400," which adamant just who could be considered part of New York society. The Vanderbilts, even so newly rich and with a reputation for crassness from their patriarch Cornelius "Commodore" Vanderbilt, were non on that list.

Despite this, William Thou. "Willie" Vanderbilt, the son of Billy Vanderbilt and grandson of the Commodore, was married to Alva Smith, a social-climbing force who was determined to be accepted into New York's high society. She spent millions of her husband's inheritance building a huge mansion on Fifth Artery's millionaire row, one of the largest homes there at the time. In one case the mansion was finished, she spared no expense throwing an extravagant ball that would successfully country Willie and Alva on the Listing of 400 in March 1883. The cost of the brawl was estimated to be over $250,000 (more than $6 1000000 today, per the Official Information Foundation). With expenses like that, it's no wonder the Vanderbilts would soon detect their fortune dwindling.

Building grand mansions, townhouses, and estates

In contrast to the Commodore and Baton Vanderbilt, the 3rd and fourth generations grew upwardly ridiculously lavishly and spent their fortunes like crazy. What they loved splurging on were assortments of grand mansions, townhouses, and estates. Co-ordinate to NYC experts at 6sqft, the Vanderbilt family owned multiple Gilded Age mansions on 5th Avenue's millionaire row, including the massive three townhouses chosen the "Triple Palaces." They also were decumbent to bouts of family competition, building huge mansions to rival each other. For case, after Alva Vanderbilt had her "Petit Chateau" constructed, her sister-in-law, Alice Vanderbilt, set up out to build an fifty-fifty larger mansion that ended up beingness the "largest unmarried family unit business firm in New York Urban center at the fourth dimension." Unfortunately, most of these would be demolished in the late 1920s after being sold to real estate developers.

While his sis-in-laws were building some of New York City's biggest mansions, George W. Vanderbilt and his wife Edith looked to Asheville, North Carolina, to build Biltmore. Finished in 1895, the 30,000-acre estate with a 250-room French Renaissance castle took six years and cost nearly $6 meg to build, which would be approximately $one.6 billion by today'due south standards, according to PocketSense. Now open to the public as a tourist attraction and national landmark, Biltmore House is considered the largest privately owned home in the entire country and is all the same operated by Vanderbilt descendants today.

The Vanderbilts were more interested in philanthropy than business concern

The Vanderbilts as well spent quite a bit of money on philanthropy and exploring their personal interests, particularly the Vanderbilts of later generations. The Commodore was known to take fabricated one large donation in 1873: a $1 million gift to Nashville, Tennessee's, Central University, which would and so be founded as Vanderbilt University, equally explained by Britannica. His son, William "Billy" Vanderbilt, would go along to donate to Vanderbilt University and even left gifts in his will to organizations similar the YMCA and the Metropolitan Museum of Art (via Britannica).

3 of Billy Vanderbilt'due south sons were particularly known for contributing to philanthropic or cultural causes. According to Britannica, Cornelius Vanderbilt 2 (not to be confused with the Commodore's 2d son), who was most prominently in charge of the family investments and businesses, donated huge amounts to the Metropolitan Museum of Fine art, Yale University, Columbia University's Higher of Physicians and Surgeons. His younger brother, William Kissam Vanderbilt, helped manage the family business organisation for a while simply shifted command of the railroads to an outside firm in 1903. Afterward that, he spent most of his time and money on sports and cultural causes, including yacht-racing, art-collecting, and operating the Metropolitan Opera. Finally, the youngest, George W. Vanderbilt, who contributed very little to the Vanderbilts' investments and enterprises, would make big donations to Columbia Academy, the American Fine Arts Lodge, and the New York Public Library.

New taxes and the Smashing Depression

According to ThoughtCo, the Vanderbilts, especially the Commodore, grew their wealth during an era where business regulation was practically nonexistent. Past existence able to monopolize entire industries, they became unimaginably rich, with no restrictions or taxes affecting their fortunes. The turn of the century, even so, saw a push for more than public services, equally well every bit a global conflict that was cutting into merchandise tariffs, equally described past Heritage and ThoughtCo. Needing new revenue sources, the United States government formally introduced the mod estate, souvenir, and income taxes in the early 20th century. Suddenly, the Vanderbilts' fortunes and inheritances were cut, and their expensive lifestyles became harder to fund.

To make matters worse, when the Great Depression hit, the Vanderbilts had to find dissimilar means to maintain their lifestyles and huge estates. For example, they had to open Biltmore to the public in 1930 to "increase surface area tourism" and "generate income to preserve the estate" (via Biltmore's Estate History).

While other wealthy families made it through this catamenia only fine, the Vanderbilts' excessive spending and lack of zeal toward growing their family wealth meant that the taxes and Depression affected them much more than seriously.

Alfred Vanderbilt's death on the RMS Lusitania

As documented past Geneanet, Alfred Gwynne Vanderbilt was the tertiary son of Cornelius Vanderbilt II and the grandson of Billy Vanderbilt. When his father died of a cerebral hemorrhage, Alfred was the main inheritor of his $72 million estate, co-ordinate to The Lusitania Resources. Despite being the third-eldest son, Alfred was thought to be the one who would best handle the family fortune. His oldest brother had died young, and his second eldest, Cornelius Vanderbilt III, had been disinherited after getting married without his parents' approval.

Unfortunately, at the young age of 38, Alfred died equally a passenger of the RMS Lusitania on May 7, 1915, when it was torpedoed and sunk by a German submarine during Earth State of war I. His early death meant that the family unit fortune was quickly divided among his married woman and young children before it was able to abound significantly under his direction, with his other brothers doing petty to contribute to the Vanderbilt fortune themselves later his death.

"Neily" Vanderbilt was disinherited after an unapproved matrimony

Cornelius Vanderbilt III, Alfred Vanderbilt's older brother, was well-educated with three degrees from Yale and poised to take over the family railroad business organization from his father. In 1896, even so, at the historic period of 23, he decided to marry his lover Grace Wilson, a decision that his parents entirely disapproved of, according to the New Netherland Plant. Three years afterward his wedding, Cornelius would understand just how intensely his family had hated the marriage. In 1899, his father died and, out of his more than $70 million estate, left Cornelius only $500,000. He had, in essence, been disinherited.

Equally described by The Lusitania Resource, most of the inheritance went to his younger blood brother Alfred, with his other siblings receiving $7 million each. Out of sympathy, Alfred gave him an actress $half-dozen million, only Cornelius would remain estranged from the rest of his family unit for decades after. On his own, Cornelius made several technological developments that earned him royalties from patents and lived a lavish life. Co-ordinate to The Gilded Age Era, Cornelius' disinheritance did non deter him or his wife from splurging on mansions, parties, yachts, and other material goods until the early 1940s. It is clear, though, at this signal in time, that the Vanderbilt family unit fortune was nowhere near what it had been earlier.

Reginald Vanderbilt gambled away his inheritance

Every bit told by Boondocks & Country, Reginald Claypoole Vanderbilt was the great-grandson of the Commodore and the younger brother of Cornelius Vanderbilt III and Alfred Vanderbilt. As the youngest son of the family unit (per Geneanet), Reginald had little involvement in the family unit business organization. He contributed nothing to the Vanderbilt family fortune and instead squandered his own inheritance away on gambling and alcohol until his death.

In that location are several anecdotes that describe his reckless lifestyle. On his 21st birthday, the night he came into his $xv.5 million inheritance, he lost $seventy,000 gambling. When he was 42, he was told by his doctors that he would die shortly if he refused to stop his alcoholic means. Instead, he connected and even married a 17-year-old socialite named Gloria Morgan. But a few years later, Reginald died from liver cirrhosis at the age of 45 in 1925. Having gambled abroad most of his inheritance, Reginald was broke and in debt, leaving behind a widow and baby daughter who would take to live off of the interest payments of the young girl's $5 million trust fund until she was 21.

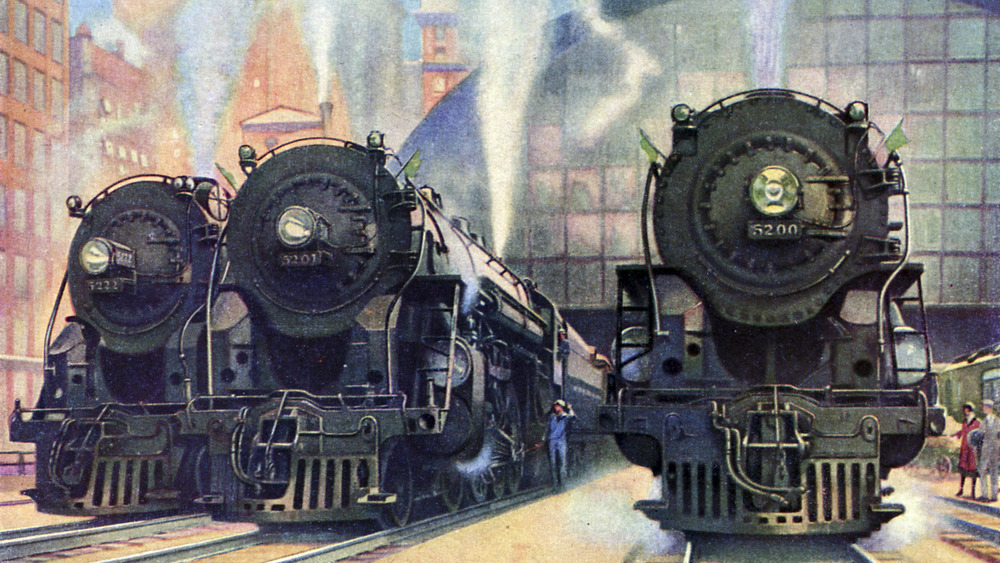

The decline of New York Cardinal and railroads

While the Vanderbilt fortune was beingness split among more than and more than descendants who loved to excessively spend their inheritances, the original source of their family'south wealth, New York Central, began to decline in the first half of the 20th century, according to Forbes. Peaking in the 1920s, the transport and freight industry began to slump in the 1930s. By the end of World War II, other modes of transportation began overtaking railroads.

The family sold their shares in New York Central, and in 1954, Chesapeake and Ohio Railway's Robert Young took over. Withal, various owners and mergers couldn't save it. New York Central went from being the second-largest railroad in the U.s.a. to having its and then-current iteration go broke in 1970. Throughout all of this, the Vanderbilts had failed to found whatever significant businesses that would have them maintain their status as one of America's wealthiest families.

Sixth-generation Vanderbilt: Anderson Cooper

The baby girl that Reggie Vanderbilt left behind by his expiry in 1925 would grow up to be way designer, writer, artist, actress, and socialite Gloria Vanderbilt, famous for her jeans in the early 1980s. With her father expressionless and her young widowed mother something of a ghost herself, Gloria was raised by nannies in France knowing very little virtually her Vanderbilt family roots and the money that she was poised to inherit, according to her eulogy that was narrated by her son, via ET.

While Gloria had a publicly successful career, she fabricated it articulate to her son, news anchor Anderson Cooper, that "there's no trust fund," as reported by the Los Angeles Times. Past the tardily 20th century, barely 100 years after the Commodore had become the richest homo in America and his son the richest man in the world, the Vanderbilt family fortune had dwindled into insignificance. When Gloria died in 2019, Cooper inherited almost of her estate, which, despite existence publicly estimated to be worth $200 one thousand thousand, only had a value of near $1.5 1000000.

Source: https://www.grunge.com/302542/how-the-vanderbilt-family-lost-their-entire-fortune/

0 Response to "what happened during 2017bthat might have cause ge to decline his net profit margin?"

Post a Comment